Auto electronics market Analysis including TPMS and gps tracking

Market Size: $390 Billion

Growth Rate: 14.42%

Market Trends for gps tracking and tire pressure monitoring

Trends and Outlook of Auto Electronics Industry

Connected car is one big area that has been swept by the revolutionizing concept called Internet of Things (IoT).

Tata Elxsi's embedded product engineering business cuts across the key segments like Automotive, Telecom and

Consumer Electronics where the adoption of M2M / Internet of things promises to make a big difference to the

automotive world.

The widespread adoption of hand held devices like Smartphone and tablets have been influencing the automotive

industry to change the customer driving experience. Presently, the user can enter a car and pair his / her smart

phone to the Head unit and do a whole set of functions like call, navigation, playing audio/video etc. Soon the

expensive infotainment head units could get replaced with smart phones or tablets with numerous applications like

cloud based navigation, fuel reminders, driver profile, locating parked vehicles, real-time traffic scenario,

battery state of charge, emergency/service assist, remote vehicle interaction etc. which will be more

ground-breaking.

As the electronics that goes into a car evolves at a rapid pace and the car progresses from an isolated unit to a

networked/connected unit, cars are becoming increasingly vulnerable to malicious attacks. With the current

advancements such as users being able to connect their personal devices like the tablet and the cell phone to the

car, access to cloud computing, car to car and car to infrastructure communications, there is nothing to stop anyone

with malicious intent and with some computer-programming skills to gain access to the vehicle ECUs and take control

of the vehicle.

Tata Elxsi is working on building security platforms like secured gateway modules which shall act as

a central point for the wired and wireless networks and prevents unauthorized usage.

The Auto industry is giving plenty of attention to the advanced driver assistance systems (ADASs) that will one day

be linked together to provide autonomous driving.

ADAS is the next big wave where we at TE are also committed

towards making the car become more safer by developing Advanced driver assistance systems (ADAS) like Lane departure

warning that alerts the driver if he / she veers away from the lanes, drowsiness detection system to warn if the

driver gets drowsy behind the wheel, blind spot monitoring that enables one to see areas around the car that you

could never see with standard mirrors and so on.

With increasing fuel costs and pollution levels, the future of the industry depends mainly on alternative fuels and

alternate mobility sources like fuel cells, solar powered etc. The challenge for companies will be to come up with

newer engines and transmission systems which will be less polluting and at the same time highly fuel efficient and

performance oriented.

Safety and security is a prime target of the industry

Even though, this is a young market still in its introductory stage, appearing in only high-end cars, it is an ever

growing and competitive market with the customers demanding for better technology at lower prices. This along with

the strict Regulations placed by various Governments on the CO2 emission levels and mandatory safety requirements

such as Crash test standards on new cars, are hard pushing the OEMs to come up with better designs in a cost

efficient way. India, being the 5th largest producer in the world of passenger cars recently placed a new regulation

standard for crash tests - NCAP(New Car Assessment Program) to ensure better driver safety and bring down the

fatalities during accidents which has been notorious in the nation.

Improving sales and marketing of Hybrid vehicles is a trend seen recently among automakers in a bid to meet up the

emission regulations. Energy conservation is tackled by increasing the efficiency of the ECUs used in key areas like

the management system in HEVs, by using multi-core microcontrollers, which takes additional roles by creating

“Virtual ECUs” and provide services in safety and diagnostics.

Safety and security has become the primary focus of both the automakers and the customers with technology

advancement. Although this sector started its story with the introduction of ABS technology by Bosch in 1978, it is

still in its infancy, but has strong possibilities of growth. With higher adoption rates of

ADAS technologies like

Night vision and Pedestrian detection systems in growing markets like Asia region, with an overall expected business

of about 30 billion by year 2020, according to

Deloitte; it is one of the most thriving markets with promise. Also,

new state regulations from European Union and the US government on installing mandatory safety features like

Back-guide monitors as a standard equipment and ensuring

eCall facilities in all passenger cars in Europe, points to

the importance of Safety systems in automotive.

Telematics clubbed with semi-autonomous features like valet parking and lane-keeping assistance and even driver

updates on the telematics data of the driver and cars are making its way into the mainstream. Even though the

adoption rate of Connected car systems is still low (about 10 - 20%), the industry looks upon it with a lot of

expectation. Also, this has sparked discussions on the importance of

cybersecurity against

possible "Car Hacks",

thus steering attention towards much needed data security in car infotainment systems and Internet of things

industry. The urban driver is empowered with information and demands for more advanced features at lower prices

which puts a lot of pressure on the OEMs and is pushing for strict competition. This ensures that better quality of

service and elevated industrial standards can be expected.

Security concerns for next generation automotive electronics

Contrary to traditional concept, a car has grown into a statement of luxury and comfort. And, this makes it a

complex system packed with electronics in every possible area. With the advent of connected cars technology and

Internet of things in cars, the role of software and networking has increased exponentially. Thus Cyber threats

which has been making its rounds in the IT sector has finally made its presence felt in the world of automotive.

With internet connectivity introduced in passenger cars, the security of the data transferred is vulnerable to

“Hacks”. The recent “wireless-carjacking” stunt in a Fiat Chrysler, by software experts Charlie Miller and Chris

Valasek has been an eye-opener to automakers, bringing the spotlight to a relatively untapped and neglected

territory.

A proper cyber security standard should be in place for data security and OEMs are seriously considering a unified

solution for it. Though a solution for Energy conservation, use of multi - core processors increases the risk of ECU

fails. In this case, if a single ECU stops working, the Virtual ECUs created by it also stops, which could be

seriously affecting the vehicle and risking the driver. Another point of concern is the increased risk to drivers

due to software crashes, since the industry is getting more into autonomous technology by relying on software. This

means a few lines of erroneous code can mean life or death. Considering such safety threats, some of the governments

have regulated the usage of autonomous cars on roads. But since this is the only way forward, we need to re-think

and find our way.

Autonomous car

Autonomous cars will be the next biggest technical innovation in the auto world. Entry of non-traditional players

like Google into this sector gives enough credibility on how much expectation is being placed in this

technology.

Driverless cars can facilitate vehicle sharing, with a few “shared” vehicles always available in the network, to

which a passenger can connect to and arrange a passage at any convenient time. Such a system can save huge amount of

energy resources thereby tackling the matter of traffic congestion, which is one of the major reasons why the OEMs

are investing more on R & D for autonomous cars. The sector that the traditional players can tap into is

“personalised” driverless cars with more scope for entertainment and personalised features, since the driver will be

freed from their traditional duty of “driving”.

Though the driverless car is a prerequisite to attaining the ultimate driver safety and comfort, it will take some

time before we actually achieve it. Currently only semi-autonomous systems are being tested and gearing up to be

rolled out in 2017-2019 models.

Privacy would become a distant dream since more data about the driver's coming-and-goings can be accessed by

insurance companies and law enforcers. This can also lead to a serious blow to Data Security since driver details

can be misused by hackers and law breakers. System failures are another concern for safe driving. There is also the

problem, of how the algorithm will behave on-road, when it faces an imminent crash with a pedestrian or an obstacle.

In such cases, the security of the passengers as well as pedestrians on road will be at stake. There is also the

moral question of accountability, on who should take the responsibility in such an event, which can put the

insurance companies in a tough spot.

Auto electronics may be one of the most competitive industries today, but it is one of the most happening one as

well, powered by a combination of innovation, brilliance and sheer creativity which is exactly what Tata Elxsi has

to offer.

We have expertise in providing solutions in every major segment in auto electronics such as Power train, Body

electronics, Chassis, Safety, security. State-of-the-art facilities for ECU testing, which can bring down testing

costs significantly for the OEMs, make our services unique. We have dedicated teams for Hardware design as well,

with lab facilities and design teams, supporting major engagements for tier-1 suppliers. Autosar compliant Basic

software development requires special mention since Tata Elxsi has been entertaining long standing relationships

with major OEMs and Suppliers with considerable services. We are making use of our strong software team to spearhead

innovation in fields like Test automation solutions, which guarantees faster results for the customers.

We are committed towards making the car safer by complying with standards like the Automotive Spice Level - 5, which

promises software quality, especially in safety critical functionalities. Also internally we have been investing in

building solutions for impending issues of Data Security in ECU systems, by putting forward new concepts and

proposals to customers, which could make considerable impact in the industry.

Cutting edge innovations and ingenious HMIs for car infotainment and critical functionalities for Driver assistance

are also our significant contributions. Since Tata Elxsi has an assorted group of engineers from Electronics,

Automotive, Electrical and Computer science trades, it is easier for us to provide multilevel solutions for the same

client - be it software or hardware. We are also active partners in consortiums like AUTOSAR, GENIVI, CAR

CONNECTIVITY, ARTOP and COMASSO thus making strategic investments that helps us to ensure that we are in-tune with

the latest industry trends. Creativity is also not lost upon us, since we have a competent unit for Industrial

Design Engineering, which comes up with futuristic aesthetics for car interiors and body designs. Tata Elxsi’s tag

line is “Engineering Creativity” and we mean to stand by it.

Automotive Electronics Market Forecast and Segments, 2016-2026

Automotive electronics comprises of electrically operated systems deployed in vehicles. Electronic fuel injection,

airbag, advanced driver assistance and infotainment are some of the areas where automotive electronic systems is

primarily used in order to increase the overall efficiency of the combined system. As electric and

hybrid vehicles

are gaining traction in the market, these systems are likely to become key focus area of electronic system

providers. Technological advancements such as electrical active suspensions and power trains for electric vehicles

in automotive industry are likely to increase the application areas for power electronic system in automotive

sector.

Moreover, government safety programs such as New Car Assessment Programs (NCAP) throughout the world are primarily

targeting to increase the overall road safety by pushing towards the development and evolution of technologies in

order to reduce the impact and likelihood of accidents for example improvement in airbag and stability of control

systems. As per estimation, around 40% of on-board components throughout a car are electronic based and this

percentage is most likely to increase with improvement in the current regulations governing automotive industry.

Automotive Electronics Market: Drivers and Challenges

Increasing safety concerns leading to advanced safety systems is primarily expected to drive the global automotive

electronics market. Moreover, powertrains, wheels, parking assistance, and electrical suspensions are the major

application areas most likely to spur the growth of the global automotive electronics market. Also, increasing

environmental sustainability plus rising demand of cutting edge infotainment systems will increase the demand for

complex electronics systems thereby driving the global automotive electronics market. Protection of complex

electronic systems from damaging electrical hazards and stringent government regulation regarding vehicle safety are

some of the major challenges facing designers in the automotive electronics industry.

Automotive Electronics Market: Segmentation

Global Automotive Electronics market can segmented by application, by vehicle type and by geography.

Based on application the global automotive electronics market can be segmented into:

• Advanced Driver Assistance Systems (ADAS)

• Body Electronics

• Entertainment

• Powertrain

• Safety Systems

Development in signal processing algorithms and sensor technology has laid the foundation for a rapid growth of the

ADAS market. ADAS segment is expected to be the fastest growing segment over the forecast period primarily due to

increased safety standards.

Automotive Electronics Market: Key Players

Some of the major players identified across the global automotive electronics market includes OMRON Corporation,

Robert Bosch GmbH, Infineon Technologies AG, HGM Automotive Electronics, Hitachi, Ltd., Delta Electronics, Inc.,

Atotech Deutschland GmbH and ZF TRW. Major players in automotive electronics systems are partnering with OEM's. Key

players across the value chain are focusing primarily towards miniaturization, lightweight materials,

electrification and intelligence, thus considering automotive electronics as a key factor of competing through

differentiation.

.jpg)

Scale of the Auto Electronics Industry

Thanks to the auto development trends focusing on lightweight materials, miniaturization, intelligence and

electrification, the market of auto electronics is experiencing a rapid growth. Europe and the United States have

improved energy-saving, emission reduction and safety performance of vehicles through mandatory regulations. The

developments in consumer electronics has given rise to more demanding requirements for communications and

entertainment functions of vehicles, so the development of safety control and communications and entertainment

electronics are expected to experience rapid growth. In view of the current situation, major OEMs will also consider

auto electronics as the key factor of competing through differentiation.

More Fierce Cross-industry Competition

With an increasing growth of information technology and consumer electronics adopted in the auto industry, the

traditional auto industry is facing an attack from new industries such as the mobile Internet, the consumer

electronics industry, etc. Internet companies want to enhance their existing business and cloud service abilities

through the acquisition and increase of the customer flow, so as to speed up the layout of car terminals, and turn

cars into an important entrance and platform of the Internet.

Leveraging their technological advantages, many information technology companies have crossed over into the auto

industry to promote the informatization and intelligent development of vehicles. Recently, Apple has released an

"iOS in the car" application, which marks the official entrance of the mobile Internet and consumer electronics

giant into the auto industry. "IOS in the car" can enable multiple functions such as map navigation, music play,

sending and receiving messages, phone call making and surfing on the Internet, all without distracting the driver.

Its advent will put an end to OEMs' traditional dominance over car-internal entertainment and navigation systems,

further speeding up the integration of internal entertainment and navigation systems with the external equipment,

including mobile phones, tablet computers, etc.

In addition to Apple's practice of entering the auto industry via the entertainment and navigation platform, more

and more Internet companies try to leverage the Internet-based services and their advantages in product R&D and in

operational management of the mobile Internet platform (e.g.: mobile phones) to gain some market share in future

telematics services. Another giant, Google, has turned to automatic driving and is trying to find a solution to free

drivers from the drudgery of driving. Google's potential success would undoubtedly pose a threat to the traditional

leading suppliers in the ADAS area.

Industry Restructuring & M&A Acceleration

Increased Centralization

Several factors combine to further increase the centralization of the auto parts industry. For one, parts purchasing

of OEMs has a tendency towards modularization in order to reduce management costs and to improve efficiency. Another

factor is that OEMs tend to depend on the parts manufacturers in terms of R&D.

The parts manufacturers therefore seek to improve their all-round capability through M&As in order to meet the

requirements of OEMs. The macro-economic gloom in Europe and US has worsened the marketing environment for parts

manufacturers, and some manufacturers have therefore had to resort to bankruptcy, restructuring or mergers.

Meanwhile, some companies experiencing a lack of funds but with advanced technology have become ideal target

companies for some cash-rich companies. For instance, Autoliv enhanced its leading position in passive safety

service areas through an acquisition of Delphi's passive safety assets in 2009.

A More Open Supplier System

Traditionally, there have been three kinds of parts supply models: the American vertical integration model, the

Germany independent supplier model and the Japanese consortium model. With increased specialization, more

centralized segments and intensified market competition, the independent and self-contained supply pattern, however,

is gradually broken down. The accelerated globalization of the auto industry also paves the way for manufacturers in

the emerging market to step into the parts supply system. Take Toyota as an example, which has established

cooperations with local Chinese suppliers. Parts manufacturers will therefore increase their independence with a

more diversified client structure and a more open supply system.

Industry Segment Development Trends

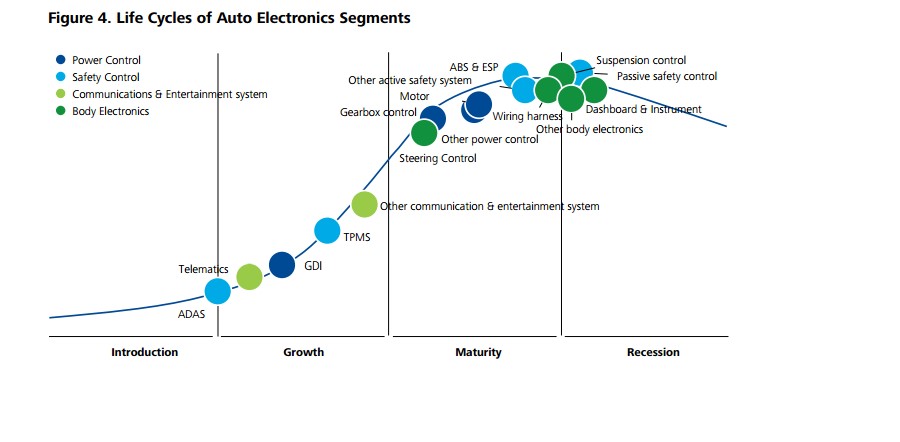

The Product Life Cycle and Technology Development Trends of Various Segments

Auto electronics can be divided into four major categories: power controls, safety controls, communications and

entertainment systems, and body electronics. At present, most products of the body electronics have entered the

mature or recession period of the product life cycle. For power controls category, GDI is still growing, and its

penetration rate in the European market is expected to increase by around 40% by 2018. As regards the safety

controls category, the assistance system for safe driving which experiences the rapid development is still in the

introduction and growth period, as it has only been applied to a small number of high-end cars. Future large-scale

adoption depends on the maturity of the technology and a decline in costs. The penetration of tire pressure

monitoring will increase rapidly in Europe and the United States, which has a relatively high population. However,

due to the lack of mandatory rules of law, it is still in the introduction period in emerging markets such as China.

Recently, OEMs have focused on communications and entertainment systems. Affected by European and US requirements

for new cars to be equipped with emergency in-vehicle information systems, embedded in-vehicle information systems

have seen rapid development, with adoption rates increasing by 17% from a level of 33% in 2010. With relatively

higher potential, in-vehicle information systems will be more widely adopted in the mass market in the future.

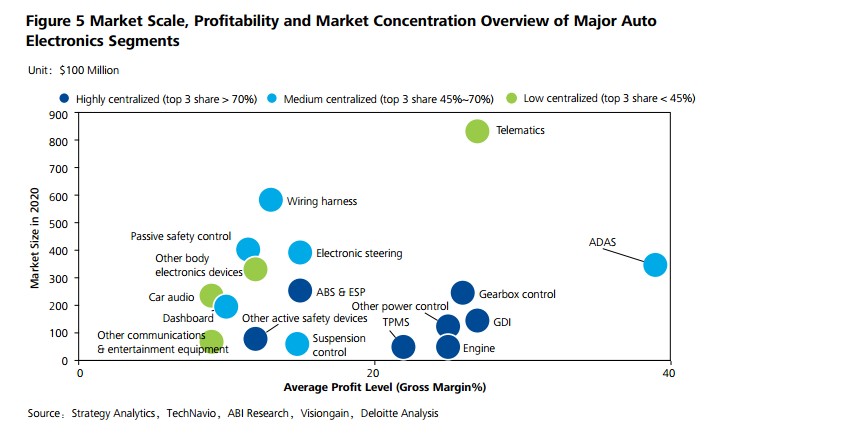

Market Scale and Average Profit Margin of Segments

Considering the product life cycle, market growth and profitability vary in different auto electronics segments.

IVIS and ADAS have experienced rapid growth, with both traditional OEMs and crossindustry manufacturers involved.

However, due to the dominance of the big manufacturers as well as technology barriers, market concentration is

relatively low. Future technology development will be uncertain and variable, resulting in considerable amounts of

capital invested in product development, and a high profit rate. On the other hand, other security controls and body

electronics markets are experiencing steady growth.

Development Trends of Target Segments and Implications for the Auto Industry

Safe/ Unmanned driving

Safety is considered the most important topic for modern auto science. With the development of auto technology,

consumers have developed increasingly high requirements in terms of car safety. Most OEMs regard safety as one of

the key factors for the competitive differentiation. Let's have a look at the safety technology products of selected

OEMs:

• The Mercedes 2014S has the Distronic Plus steering assistance system, including a 360o sensor system based on 6

radar systems and a stereo camera, as well as 12 ultrasonic sensors

• Safety City, the Volvo's automatic braking system can avoid low speed rear-end accidents which account for 75% of

urban traffic accidents.

Nissan's Safety Shield system is controlled by an intelligent acceleration pedal based on camera sensors .

• Cadillac's safety alert seat system will be directionally tactile in the way they vibrate the drivers' seat

pads.

Opportunities for Global Auto Electronics

85% of all innovations in cars today are in electrical/electronics

Value content of “electrical /electronics” in an average car is 33%* today and increasing fast

Growth through material innovation to increase performance and reliability from the OUTSIDE - e.g., protective

coatings and gels

Major growth through thermally conductive materials to prevent overheating and protect components from the INSIDE

-16% compounded annual average growth

MARKET DRIVERS

• Cost

• Reliability

• Miniaturization

• Environmental

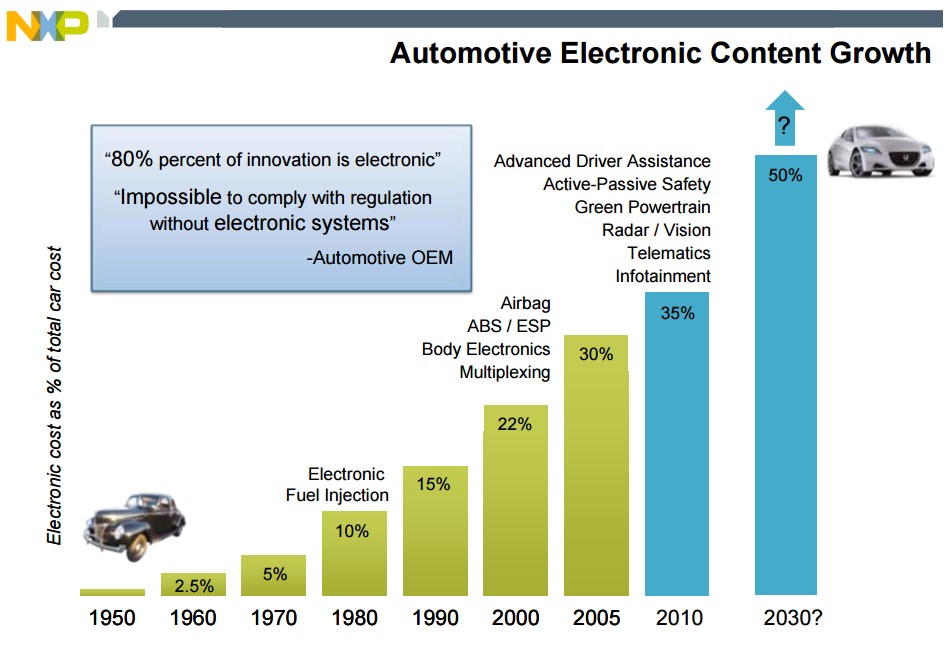

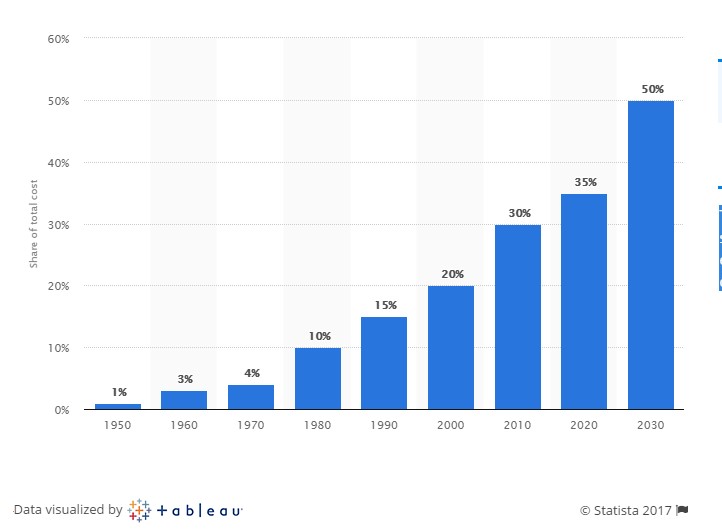

Automotive electronics cost as a percentage of total car cost worldwide from 1950 to 2030

This graph shows automotive electronics cost as a share of total car cost from 1950 to 2030. In 2000, the

electronics content in cars accounted for 20 percent of an automobile's total production cost.

The automotive electronics market: A view from a material supplier

Large efforts are being deployed in the car industry to transform the driving experience. Electrical vehicles are in

vogue and governments are encouraging this market with tax incentives. Cars are becoming smarter, capable of

self-diagnostics, and in the near future will be able to connect with each other. Most importantly, the

implementation of safety features has greatly reduced the number of accidents and fatal- ities on the roads in the

last few decades. Thanks to extensive computing power, vehicles are now nearing autonomous driving capability. This

is only possible with a dramatic increase in the amount of electronic devices in new vehicles.

Recent announcements regarding acquisitions of automotive electronics specialists by semiconductor giants and

strategic plans from foundries highlight the appetite from a larger spectrum of semiconductor manufacturers for this

particular market. Automotive electronics has become a major player in an industrial transformation.

Automotive electronics is, however, very different from the consumer electronics market. The foremost focus is on

product quality, and the highest standards are used to ensure the reliability of electronics components in vehicles.

This has also an impact on the quality and supply chain of materials such as gases and chemicals used in the

manufacturing of these electronics devices.

Automotive electronics market: size and trends

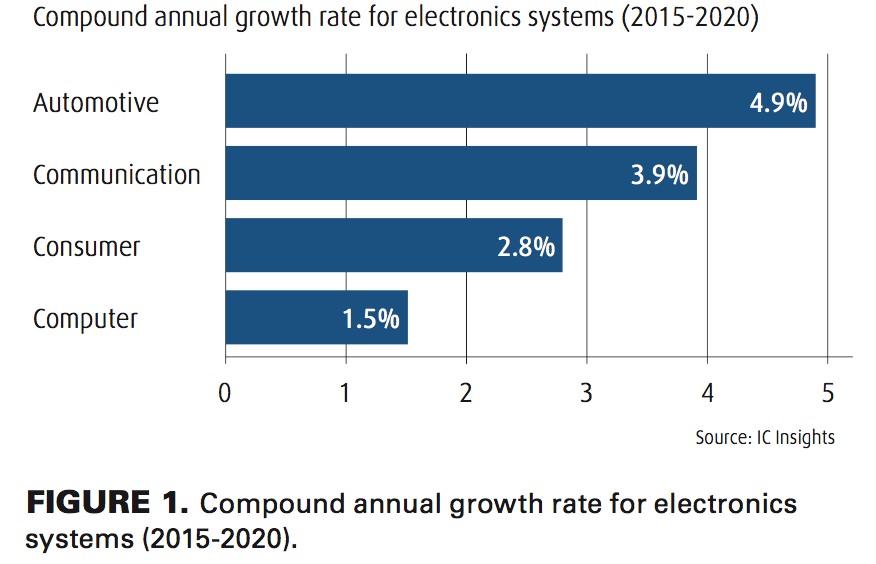

When you include integrated circuits, optoelectronics, sensors, and discrete devices, the automotive electronics

market reached around USD 34 billion in 2016 (FIGURE 1). While this represents less than 10% of the total

semiconductor market, it is predicted to be one of the fastest growing markets over the next 5 years.

There are several explanations for such growth potential:

The vehicle market itself is predicted to steadily grow on an average 3% in the coming 10 years and will be

especially driven by China and India, although other developed countries will still experience an increase in

sales.

The semiconductor content in each car is steadily increasing and it is expected that the share of electronic systems

in the vehicle cost could reach 50% of the total car cost by 2030 (FIGURE 2).

While it is clearly challenging to describe what the driving experience will be in 10 to 15 years, some clear trends

can be identified:

Safety: The implementation of integrated vision systems, in connection with dozens of sensors and radars, will allow

thorough diagnoses of surrounding areas of the vehicles. Cars will progressively be able to offer, and even take

decisions, to prevent accidents.

Fuel efficiency: The share of vehicles equipped with (hybrid) electrical engines is expected to steadily grow. For

such engines, the electronics content is estimated to double in value compared to that of standard combustion

engines.

Comfort and infotainment: Vehicle drivers are constantly demanding a more enhanced driving experience. The

digitalization of dashboards, the sound and video capabilities, and the customization of the driving and passenger

environment should heighten the pleasure of time spent in the vehicle.

In order to coordinate all these functions, communication systems (within the vehicle, between vehicles, and between

vehicles and infrastructures) are critical and large computing systems will be necessary to treat large amount of

data.

Quality really makes automotive electronics different

Automotive electronics cannot be defined by specific technologies or applications. They are currently characterized

by a very large portfolio of products based on mature technologies, spanning from discrete, optoelectronics, MEMS

and sensors, to integrated circuits and memories.

Until now, the automotive electronics market has been the preserve of specialized semiconductor manufacturers with

long experience in this field. The reason for this is the specific know-how required for quality management.

A component failure that appears harmless in a consumer product could have major safety consequences for a vehicle

in motion. Furthermore, operating conditions of automotive electronics components (temperature, humidity, vibration,

acceleration, etc.), their lifetime, and their spare part availability are differentiators to what is common for

consumer and industrial devices

Currently, some of the most technologically advanced vehicles integrate around 450 semiconductor devices. As they

become significantly more sophisticated, the semiconductor content will drastically increase, with many components

based on the most advanced semiconductor technology available. Introducing artificial intelligence will require

advanced processors capable of computing massive amount of data stored in high-performance and high capacity memory

devices. This implies that not only the most advanced semicon- ductor devices will be used, but that these will need

to achieve the highest degree of reliability to allow a flawless operation of predictive algorithms.

It is expected that smart vehicles capable of fully autonomous driving will employ up to 7,000 chips. In this case,

even a failure rate of 1ppm, already very low by any standard today, would lead to 7 out of 1,000 cars with a safety

risk. This is simply unacceptable.

The automotive electronics industry has therefore introduced quality excellence programs aimed at a zero defect

target. Achieving such a goal requires a lot of effort and all constituents of the supply chain must do their

part.

The automotive electronics industry is one of the most conservative in terms of change management. Long established

standards and documentation procedures ensure traceability of design and manufacturing deviations. Qualification of

novel or modified products is generally costly and lengthy. This is where material suppliers can offer competence

and expertise to provide material with the highest quality standards.

What does this mean for a material supplier?

As a direct contact to its customer, the material supplier is responsible for the complete supply chain from the

source of the raw material to the delivery at the customer's gate. The material supplier is also accountable for

long-term supply in accordance with the customer's objectives.

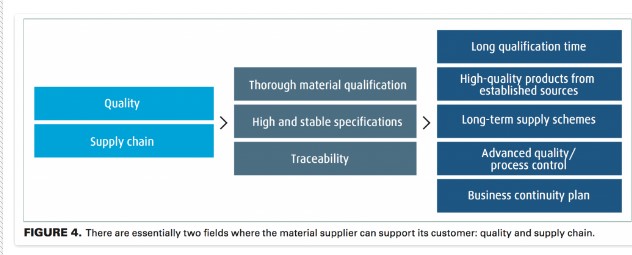

There are essentially two fields where the material supplier can support its customer: quality and supply chain

(FIGURE 4).

Given the constraints of the automotive electronics market, material qualification must follow extensive procedures.

While a high degree of material purity is a prerequisite, manufacturing processes are actually much more sensitive

to deviations of material quality, as they potentially lead to process recalibration. Before qualification starts,

it is critical that candidate materials are comprehensively documented. This includes the manufacturing process, the

transport, the storage, and, where appropriate, the purifi- cation and transfill operations. Systematic auditing

must be regularly performed according to customers' standards. As a consequence, longer qualification times are

expected. Any subsequent change in the material specification, origin, and packaging must be duly documented and is

likely to be subject to a requalification process.

Material quality is obviously a critical element that must be demonstrated at all times. This commands the usage of

high-quality products with a proven record. Sources already qualified for similar applica- tions are preferred to

mitigate risks. These sources must show long-term business continuity planning, with process improvement programs in

place. Purity levels must be carefully monitored and documented in databases. State-of-the-art analysis methods must

be used. When necessary, containment measures should be deployed systematically. Given the long operating lifetime

of automotive electronic compo- nents, failure can be related to a quality event that occurred a long time

before.

Because of the necessary long-term availability of the electronics components and the material qualification

constraints, manufacturers and suppliers will generally favor a supply contract over several years. Therefore, the

source availability and the supply chain must be guaranteed accordingly.

Material suppliers are implementing improved quality management systems for their products in order to fulfill the

expectations of their customers, in terms of quality monitoring and trace- ability. Certificate of analysis (COA) or

consistency checks are not sufficient anymore; more data is required. In case deviation is detected, the inves-

tigation and response time must be drastically reduced and allow intervention before delivery to the customer.

Finally, the whole supply chain must be monitored.

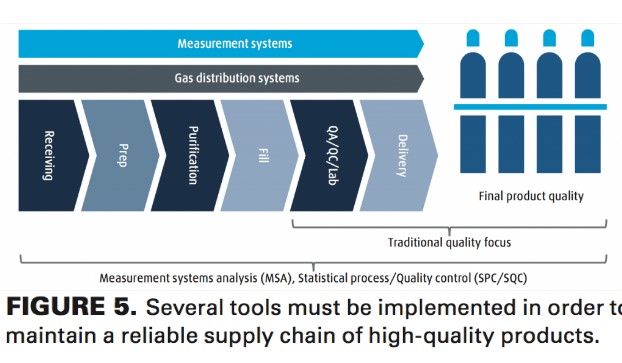

Several tools must be implemented in order to maintain a reliable supply chain of high-quality products (FIGURE 5):

statistical process and quality controls (SPC/SQC), as well as measurement systems analysis (MSA), allow systematic

and reliable measurement and information recording for traceability. Imple- menting these tools particularly at the

early stages of the supply chain allows an “in-time” response and correction before the defective material reaches

the customer’s premises. Furthermore, some impurities that were ignored before may become critical, even below the

current detection limits. Therefore, new measurement techniques must be continuously inves- tigated in order to

enhance the detection capabilities.

Finally, a robust supply chain must be ensured. It is imperative for a material supplier to be prepared to handle

critical business functions such as customer orders, overseeing production and deliveries, and other various parts

of the supply chain in any situation. Business continuity planning (BCP) was introduced several years ago in order

to identify and mitigate any risk of supply chain disruption.

Analyzing the risks to business operations is fundamental to maintaining business continuity. Materials suppliers

must work with manufacturers to develop a business continuity plan that facilitates the ability to continue to

perform critical functions and/or provide services in the event of an unexpected interruption. The goal is to

identify potential risks and weakness in current sourcing strategies and supply chain footprint and then mitigate

those risks.

Because of the efforts necessary to qualify materials, second sources must be available and prepared to be shipped

in case of crisis. Ideally, different sources should be qualified simultaneously to avoid any further delay in case

of unplanned sourcing changes. Material suppliers with global footprint and worldwide sourcing capabilities offer

additional security. Multiple shipping routes must be considered and planned in order to avoid disruption in the

case, for instance, of a natural disaster or geopolitical issue affecting an entire region.

Material suppliers need to be aware and monitor regulations specific to the automotive electronics industry such as

ISO/TS16949 (quality management strategy for automotive industries). This standard goes above and beyond the more

familiar ISO 9001 standard, but by understanding the expectations of suppliers to the automotive industry, suppliers

can ensure alignment of their quality systems and the documentation requirements for new product development or

investigations into non-conformance.

Future of automotive electronics Products and Services

With the increasing sophistication of future vehicles, new and more advanced semiconductor technologies will be used

and vehicles will become technology centers. These technologies will allow communication and guidance computing.

Most of these components (logic or memory) will be built by manufacturers relatively new to the automotive

electronics world— either integrated device manufacturers (IDM) or foundries.

In order to comply with the current quality standards of the automotive industry, these manufacturers will need to

adhere to more stringent standards imposed by the automobile industry. They will find support from materials

suppliers like Linde that are capable of deliv- ering high-quality materials associated with a solid global supply

chain who have acquired global experience in automotive electronics.

GPS Tracking Device Market worth 2.89 Billion USD by 2023

"Advance GPS tracker to hold the largest market share in the overall GPS tracking device market during the forecast

period"

The growth of GPS tracking device market is driven by the growth of commercial fleet management and declining prices

of GPS trackers. Advance tracker is professionally installed in the commercial vehicles to provide engine diagnosis

data and vehicle performance-related information in addition to basic function. The information related to engine

diagnosis can further be utilized to measure the performance of the vehicle in near-real time. Thus, this will

likely to lead the adoption of advance GPS trackers.

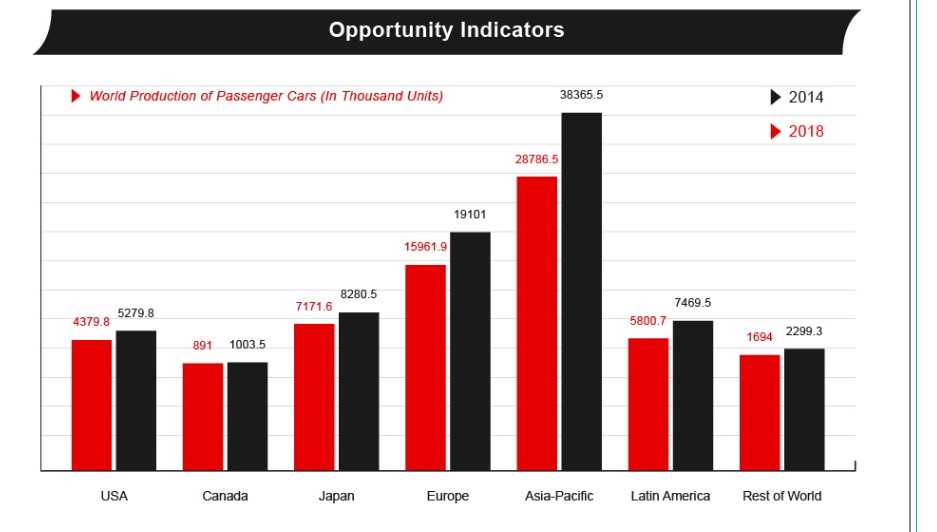

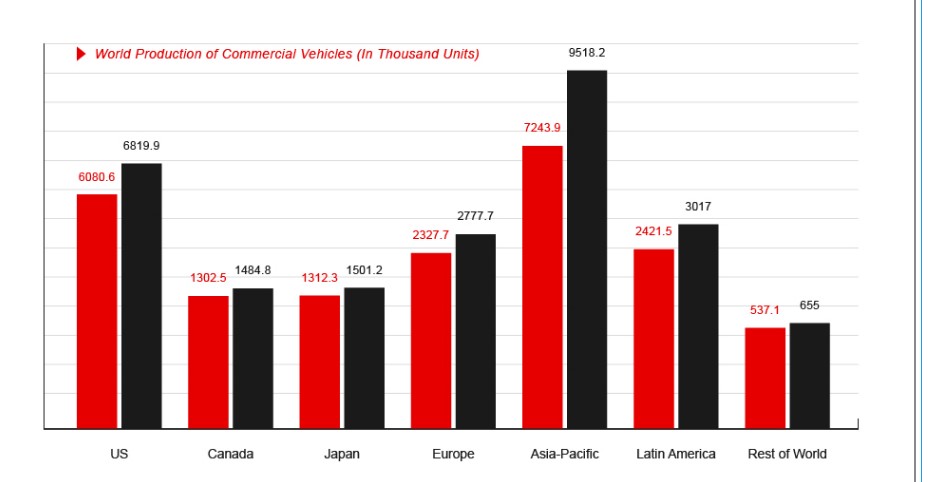

"Commercial vehicle deployment type is expected to hold the largest market share in 2023"

Deployment of GPS tracking device helps to track and monitor commercial vehicles such as trucks, buses, heavy

commercial vehicles, and construction vehicles. These vehicles are loaded with valuable goods, and thus it is

important to track and monitor these commercial vehicles. Moreover, according to International Organization of Motor

Vehicle Manufacturers (OICA), sales of commercial vehicles are on an uptrend and may drive the GPS tracking device

market.

"APAC region is expected to lead the GPS tracking device market between 2017 and 2023"

APAC is an emerging market for GPS tracking devices. The adoption rate of GPS tracking device in this region is low

compared to other regions. Thus, it is an untapped market with a huge potential for growth of GPS tracking device.

Asset's safety and security is the key driver for the growth of the GPS tracking device market in APAC. Moreover,

supportive government programs, various events and conferences, and product launches and developments are also

driving the growth of the market in APAC.

The major players involved in this market include Calamp Corp. (US), Orbocomm Inc. (US), Sierra Wireless Inc.

(Canada), Quelink Wireless Solution Co., Ltd. (China), Concox Wireless Solution Co., Ltd. (China), TomTom

International BV (Netherlands), Laird PLC (UK), Atrack Technology Inc. (Taiwan), Meitrack Group (China), Teltonika

UAB (Lithuania), Trackimo LLC (US), and Geotab Inc. (Canada).

The Growth of GPS Personal Tracking Devices

Personal GPS tracking devices and applications are expected to grow at least 40 percent per year, according to

technology marketing intelligence firm ABI Research. Additionally, the combined market for personal GPS tracking

devices and their applications is expected to exceed one billion dollars by the year 2017, reports the firm.

While a National Defense Magazine study predicts that by the year of 2014 one million personal GPS tracking devices

will be in use, ABI Research expects that 2.5 million units will be in use by 2017.

What are the areas of usage expected to see the most growth? Elderly, remote workers, and healthcare will likely see

the most growth. Insurance companies will continue to encourage the use of dedicated and approved personal GPS

tracking devices to decrease liability. Other markets that will be using GPS personal trackers in increasing numbers

include pet, offender tracking, and luggage tracking.

Families are expected to use personal trackers more in areas of tracking toddlers, pets, and parents who have

Alzheimer's or dementia. An uptick in the monitoring of health conditions through EKG readings, heart rate,

dehydration levels, and body temperatures is also predicted, with more medical professionals embracing the

technology.

Additionally, wearable personal GPS tracking devices, like watches, shoes, and bras, are anticipated to grow as

mobile technology opens up new channels for people to remotely monitor family members or others who need to be

tracked. It's also probably that we will soon see a line of infant pajamas equipped with sensors that send

information about a baby's vital signs (heart rate, oxygen level, and body temperature) to the parent's mobile

devices.

Two-way tracking devices have mostly been employed by the Defense Department, but hikers, skiers, and workers in

remote areas will be seen using the devices with more frequency, particularly if price-points come down and device

size continues to be smaller.

Currently, the GPS personal tracking market may be underserved as consumers lack knowledge of exactly what the

technology can do and are unaware of the potential benefits. So, expect to see more ubiquitous, swift, and

widespread rollouts of personal tracking devices not only in the military, government, and medical markets, but the

consumer segment as well during the next five years.

Personal tracking to be the next billion dollar GPS market

GPS personal tracking devices and applications are forecast to grow with a CAGR of 40%, with both markets breaking

$1 billion in 2017 according to ABI Research. Senior analyst Patrick Connolly says, "The hardware market remained

below 100,000 units in 2011. However, it is forecast to reach 2.5 million units in 2017, with significant growth in

elderly, health, and lone worker markets. Dedicated devices can offer significant benefits, with insurance and

liability increasingly encouraging the use of approved equipment."

"We are also seeing the first signs of leading CE companies entering the market, such as Qualcomm, Apple (via

PocketFinder), Garmin, Cobra, etc. and there will also be significant partnerships and acquisitions in this space as

new entrants looks to add tracking to their portfolio," adds Connolly. Other markets include family, personal items

(e.g. luggage), and pet and offender tracking.

There is an addressable market of over 120 million people across these markets alone, with over two million US

elderly using non-GPS Personal Emergency Response Systems (PERS). However, awareness, battery life, economic

conditions, and high subscription fees remain significant barriers. There is also a fear that smartphone

applications will cannibalize the market.

The application market is already booming, with Life360 reaching 10 million downloads for its family locator

application. Long term, these solutions will become part of much bigger security and health markets, growing to over

200 million downloads in 2017, as well as the majority of total tracking market revenue. Group director Dominique

Bonte adds, "In particular, carrier platforms represent a major revenue generator opportunity for family locator

applications, matching their secure image and offering differentiation to family subscription plans. Companies such

as Location Labs and TCS are already seeing success in this space."

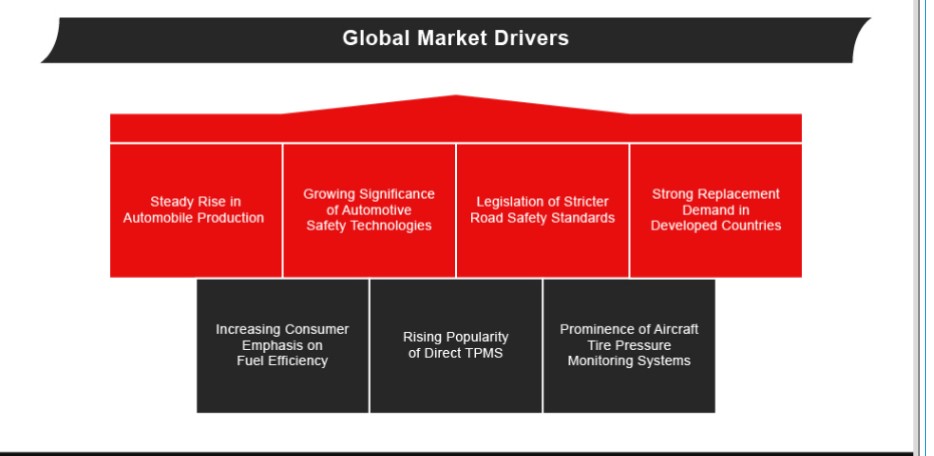

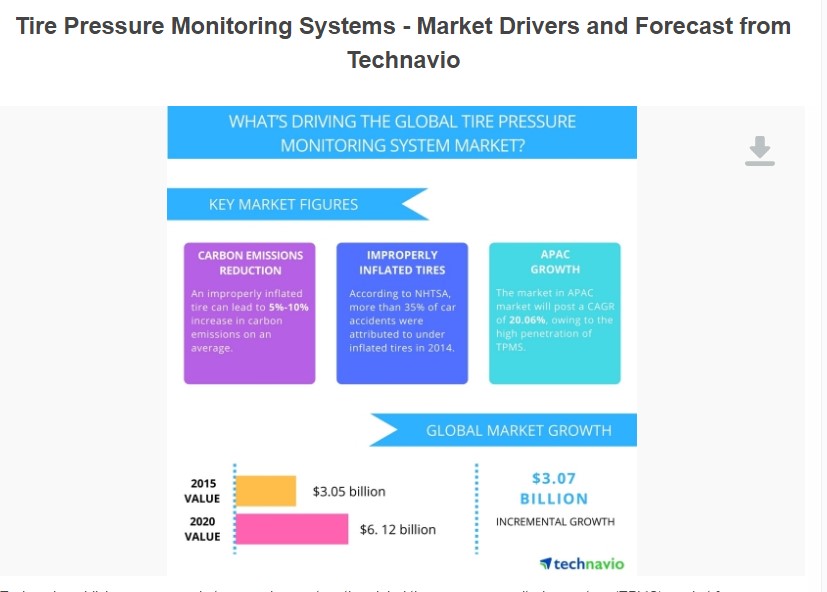

Customer Needs in Tire Pressure Monitoring Market

Reduction in fuel consumption and carbon emissions from vehicles

Strict government mandates to curb vehicular emissions and increase fuel efficiency

TPMS form a part of rapidly growing ADAS market

Reduction in fuel consumption and carbon emissions from vehicles

Advance automotive technologies are aimed at making the driving experience safer, comfortable, and convenient in

addition to making them eco-friendly in nature. Rolling resistance from tires plays a crucial role in delivering the

optimum fuel efficiency and level of exhaust emission from the vehicle. It has been found that low pressure in the

tire leads to high rolling resistance. According to industry experts, with every 1 bar pressure drop in the tire

from the stipulated value, the rolling resistance of tire increases by 20%-25% in passenger cars. A higher rolling

resistance leads to increased fuel consumption by the engine, which results in significant reduction of the

vehicle's fuel efficiency.

The need for a device that can monitor the tire pressure continuously becomes crucial for optimum fuel efficiency

and lower emissions. TPMS is one of those systems that can continuously monitor tire pressure to increase fuel

efficiency can help reduce the exhaust emission from the vehicles by 0.6%-0.9%, which may arise due to under

inflated tires.

Strict government mandates to curb vehicular emissions and increase fuel efficiency

The governments and automotive governing councils of various nations worldwide are encouraging the use of advanced

systems and technologies that can help in reduction of vehicular emissions for a cleaner and healthier environment.

In addition to these, governments of many countries have enforced various rules and initiatives that are aimed at

the use of energy-efficient technologies. Gauging at the consequences of greenhouse effects and deteriorating air

quality with increased vehicular emissions worldwide, the governments of various economies have mandated emission

standards to be followed by the automakers.

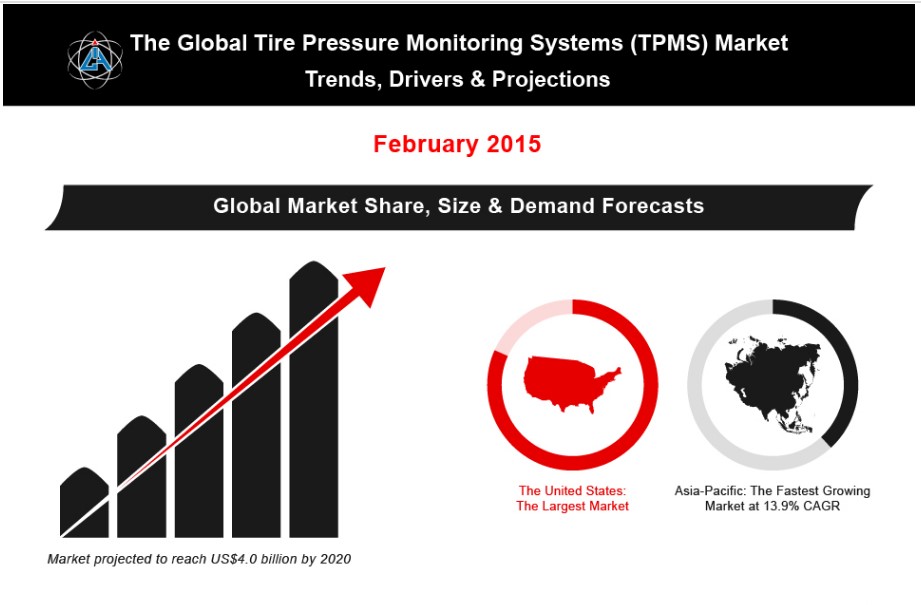

Automotive tire-pressure monitoring market to grow over 6% by 2024

The global market for automotive TPMS (Tire-pressure monitoring system) is anticipated to reflect a CAGR of over 6

percent during the forecast period 2016-2024, according to a recent report published by Persistence Market Research

(PMR).

The market for automotive TPMS in North America is relatively larger than other regions. However, the APEC

automotive TPMS market is expected to overtake and emerge as the leading market by the end of 2024.

Factors such as strict government regulations making TPMS mandatory in passenger cars, higher focus on enhancing

fuel efficiency and rapid adoption of automotive safety technology are expected to drive the global market for

automotive TPMS during the forecast period, said the report.

On the basis of vehicle type, passenger car is the leading segment of the market. In terms of value, the segment is

projected to account for 79 percent share of the market by the end of 2016. Demand for automotive TPMS in passenger

cars is more due to the higher sales of luxury cars.

Based on sales channel, aftermarket is anticipated to be the largest segment of the market during the forecast

period. By 2016 end, the segment is expected to account for a significant share of the market. Moreover, shorter

replacement cycle of direct TPMS and global increase in automobile count are projected to drive sales through the

aftermarket, especially in Europe and North America where the use of TPMS system in passenger vehicles is

mandatory.

Based on region, North America is the leading market for automotive TPMS and is projected to account revenue share

of over 47 percent of the overall market by the end of 2016. Europe is expected to witness an overwhelming demand

for automotive TPMS owing to stringent regulatory norms that make TPMS compulsory in passenger vehicles.

Swot Analysis of the Industry

Strengths

-Access to comparable industries is possible.

-The industry is more robust than the economy in general.

-The industry has unique products and services.

-The industry shows a strong diversification.

-The industry provides future trends.

Weaknesses

-Profitability could be higher in this industry.

-The industry still faces barriers.

-We see high investments in research and development.

Opportunities

-The industry faces a recovery.

-New trade agreements between countries are possible.

-We see global growth opportunities.

Threats

Changes in acquisitions can impact the business

Increases in price inputs can cause upward pricing

Technological Problems